OLYMPIA, Wash. – As lawmakers continue to craft a balanced two-year budget before the 2025 legislative session wraps up at the end of the month, part of those negotiations has revolved around increasing property tax revenues.

“This is the wrong answer for Washington, it’s the wrong answer for homeowners, it’s the wrong answer for renters,” Senate Minority Leader John Braun, R-Centralia, told reporters at a press event around property tax proposals Wednesday.

Republicans have come out against many of the tax proposals from Democrats in control of the legislature, especially Senate Bill 5798.

The legislation would get rid of the 1% revenue growth limit for regular property taxes, and allow that revenue to grow based on a formula that accounts for inflation and population change. The proposal also includes property tax exemptions for seniors and people with disabilities.

House Democrats have a similar proposal, without the tax exemption but with revenue growth capped at 3%.

Democratic leaders have argued property tax revenues to fund schools and public safety have not kept up with increasing costs.

“We need to make sure that we don’t have a structural problem in our laws that prevents our government from being successful at its basic functions,” said Senate Majority Leader Jamie Pedersen, D-Seattle.

Pedersen said his caucus is “very sensitive” to making sure people are not priced out of their homes. He also argued the fixed-rate property taxes from the state, counties and cities covered by the growth limit and proposed increase are a “relatively small” portion of a homeowner’s overall tax bill.

“The vast majority of what people experience as property tax increases comes from voter-approved levies,” he said.

But Republicans fear increased property taxes would make it harder for people to buy or rent a home, stay in that home and for housing to be constructed.

“They cannot say that they support affordability in our state if they also support regressive taxes that decrease affordability for people all across our state,” said Sen. Chris Gildon, R-Puyallup.

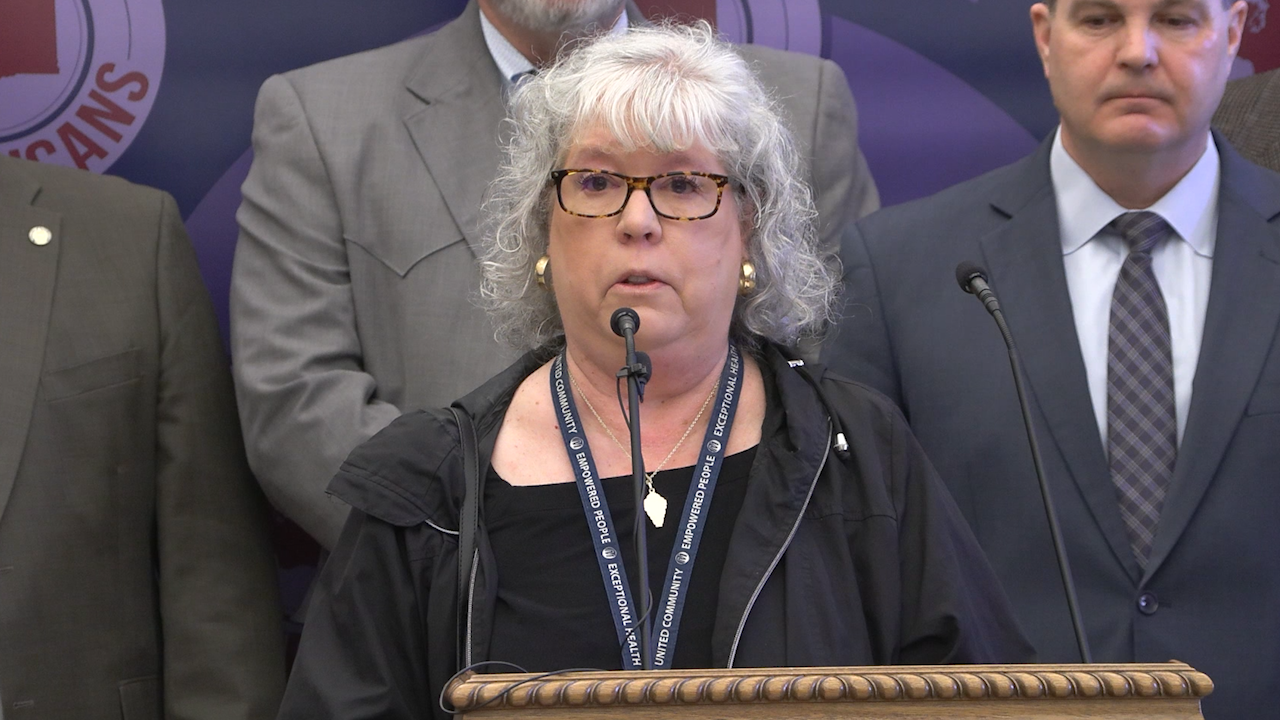

Mason County homeowner Marie Gofigan, invited to speak by Senate Republicans, said she is already struggling with making increased property tax payments because the value of her home is increasing.

“After three years of hard work, dipping into my retirement and selling my mother’s jewelry, I was finally able to get caught up,” she said. “However, now, I need to make the property taxes again due this month. Now, Senate Bill 5798 is being presented and will again put me and others like me on the brink of losing our houses.”

While Governor Ferguson held a press conference last week criticizing Democratic wealth tax proposals, he would not say much on property taxes and other revenue ideas.

“Those are conversations we’re going to have, there’s a lot of negotiations to go on,” he told reporters last Tuesday. “But I’m just not going to get into specific proposals right now.”

Democratic leaders told reporters they are in ongoing discussions with the governor’s office and would be releasing more revenue options that are under consideration within the next week.

Albert James is a television reporter covering state government as part of the Murrow News Fellowship program – a collaborative effort between news outlets statewide and Washington State University.

COPYRIGHT 2025 BY KXLY. ALL RIGHTS RESERVED. THIS MATERIAL MAY NOT BE PUBLISHED, BROADCAST, REWRITTEN OR REDISTRIBUTED.